EXIT PLANNING

Developing an Exit Strategy

Waiting till its time to depart your company is no time to plan an exit strategy. Surprises happen. Many of us know someone who had to sell their business unexpectedly. The reason could be an accident or a serious health problem. Or, it could be the offer of a lifetime from your manager to buy-out the company, a colleague, or enterprising entrepreneur. Having an exit strategy enables you to function when the unexpected happens.

The phrase "exit strategy" sounds final, as though you have decided to sell your business tomorrow. But, for most business owners, this strategy is not only about where they want to be in five years, or twenty years, it's about planning for success and sucession when you're ready to sell.

Plans to sell your company should ideally be made at the time of start-up. If you have a goal in mind, you'll be focused on maximizing profits and building a future. Dreaming of financial security or preparing to be financially secure...it's the same concept, but one works and the other doesn't. In his book,"The Seven Habits of Successful Living" author Stephen Covey" says "begin with the end in mind". Those who have created a successful business know it doesn't happen without planning, hard work, and some luck. Yet most business owners have no exit plan for transitioning their business and transferring it to a new owner. The world's oldest business is a Japanese temple construction company that has been run by the same family since 578 A.D. Your business may or may not last that long, but one thing is sure: You won't be around to see it. Whether you plan to sell, close or pass the business on to your heirs, it's never too early to think about an exit strategy. The idea that your business will provide you with income after you are no longer there may not be a reality. You have to depend on yourself. Take the time to look at the four factors of a business exit strategy: death, disability, divorce, and departing. To have a successful business, you must plan for all four of these events.

Business Transfer Motives

Death: Death of a small business owner should be considered during the start-up of a business. Unfortunately, during the creation of many buy/sell agreements the topic of death is only addressed at the urging of a life insurance agent. At the meeting, you arbitrarily decide how much insurance you can afford and how much your company is worth, when in fact you do not know.

Disability: Death is not as likely to end the business relationship as disability. Small business survival will often take prescedence over paying a disabled partner. If the person is important to the business, the financial strain impacts the business and the family who depends on the income.

Divorce: What if the partners cannot get along? How do we split a partnership without financially ruining each other? It may be complicated by many personalities, some may not even be a part of the dispute, yet may be affected financially.

Departure: You may all be happy working together, but either partner or you may decide to leave for another opportunity or simply to take life easier. Who is going to do the work? What is owed the leaving partner? Where is the money coming from? All important considerations for your business exit strategy.

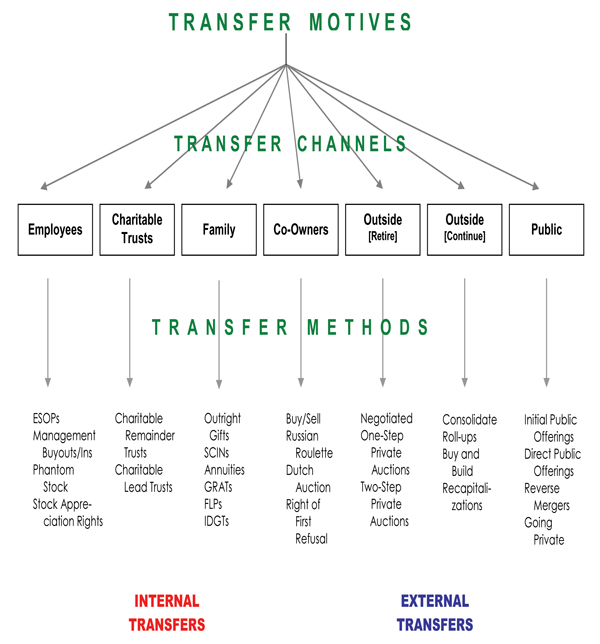

Below is a simple chart showing in more detail the channels and transfer methods that can be employed...the choice naturally depends on the personal circumstances.

A Fair Buy/Sell Agreement

For the mid-market business owner, each one of the transfer motives has special demands on: the family, income, taxes, and transfer of control of assets. An agreement, commonly called buy/sell agreements, can be used to handle these methods. The concern of the family or income can conflict with the business. The business exists as a separate entity. Reduce conflict by developing mutual fair agreements and the desired level of income.

Once you understand the methods, include the following actions in the creation of your business exit strategy:

- Consider incorporating your business to legally recognize yourself and your business as separate entities

- Find a method of determining the value of the corporation that can be done at least annually and will qualify under IRS standards

- Develop an employee benefit plan that will assist with the departure of each partner in case of death, disability, or retirement

- Plan for who retains company ownership and who gets paid off

Many owners of closely held businesses hope to pass their businesses on to the next generation of family leaders. If that's what you're planning, you should have begun grooming a successor during the years your business was maturing. If not, start today! it's a process that can take many years. Selling your business is a popular expectation of many entrepreneurs. Many potential buyers exist for well-run, profitable companies. They include other companies, both large and small, investors in the public stock market, other entrepreneurs and employees. No matter who the buyer is, a successful sale usually begins at leat five years before the actual transaction. Business buyers are paying for the right to the future cash flows the business will generate. These cash flows must be significant enough to justify the purchase price, which is often based on a multiple of those projected cash flows. It is therfore vital to document the reasons you expect future cash flows will reach a certain level. It invariably means careful record keeping, well-written documentation and thorough marketing and financial plans.

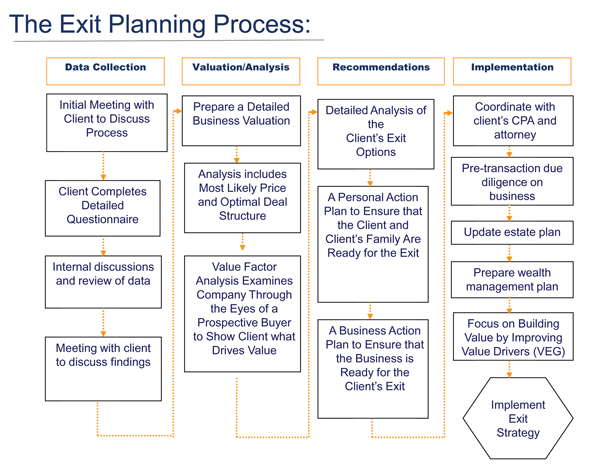

Below is an overview of the Exit Planning Process, which ensures careful attention is paid to all the factors which govern the ultimate succession.

An Exit Strategy for Success

The right strategy is about maximizing the value of a business, step by step, now and for when you want to leave. Most owners want to minimize their tax consequences, for instance, but this tactic reduces the maximization of value. This is one of the significant steps that may need attention. Most small business owners already know the basics to create an exit strategy. They probabaly know how much money they want to have by a certain age and how much risk they are willing to take. Know why they are in the business and what is most important to them. Each business owner is unique and the interests and background they have means each will need special plans for the future. But, these are just the first steps on a journey to an exit. Do you want to retire to some island paradise, or do you plan to hang around after the sale? Do you want one of your colleagues or children to take over? How does that affect the amount of money you can expect to get up front? Is your business one where your personality and abilities are critical to the value of the company? You may need time to hire and train key people, and gradually put more distance between yourself and the company. BBNY has the knowledge, experience and expertise to assist you in developing a sound Exit Strategy...one where you can feel at peace that your sucession will ensure a comfortable next phase of your life.

Call BBNY today to get started at 585-624-7998 or Email , we look forward to hearing from you.